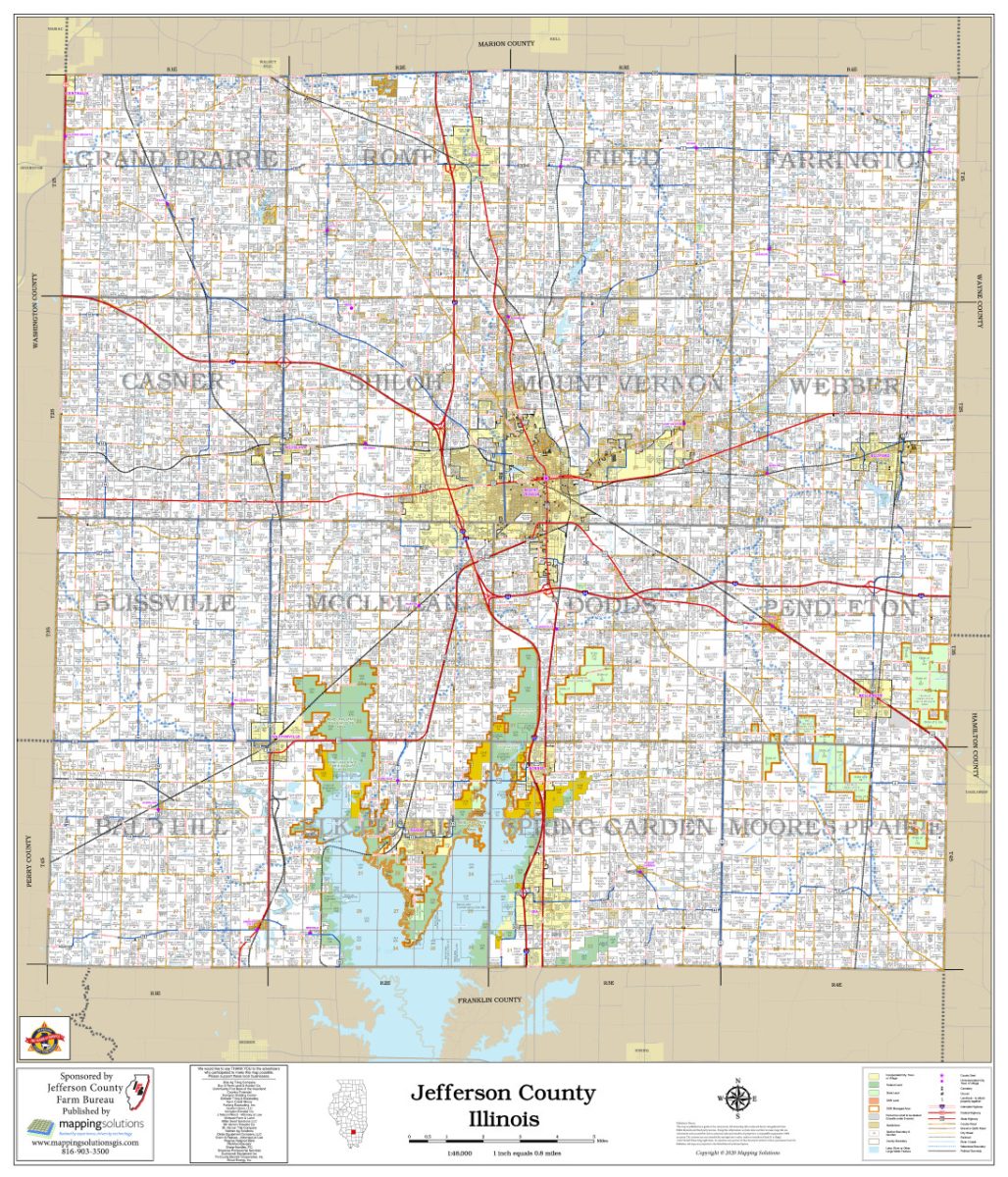

Jefferson County is one of the few counties in Illinois that has yet to pass the 1% sales tax initiative to fund schools, which was made possible in 2007 by legislative action in the Illinois General Assembly.

This tax would add one cent on every dollar of a purchase on anything in the municipal and county sales tax base except cars, trucks, ATVs, boats, RVs, farm equipment and parts, farm inputs, drugs, mobile homes, unprepared foods, and services.

The tax aims to create new sources of revenue for local schools in addition to property tax.

Eligible uses would include new facilities, additions and renovations, roof repairs, parking lots, and, most importantly, SROs or mental health professionals.

This added source of income would not be used for direct instructional costs, buses, as well as salaries, and overhead.

MV Superintendent Mr. Chad LeCrone explained what the high school would do with the added revenue. “It would be utilized for added school safety, additional school resource officers, and upgrading current facilities,” he also shares how it would be used to pay off school debt.

According to former MV Superintendent Mrs. Melanie Andrews, this tax would fund “new projects, upkeep, and necessary staff like SROs and security personnel.”

As state funds fluctuate a steady form of income would be beneficial to schools across the county.

“The schools are desperately in need of money because states aren’t funding them like they should,” said Mayor John Lewis.

“We have a Department of Education that has thousands making thousands while you’re paying your third-grade teachers 35,000 dollars,” added Lewis, “We need to start by putting money back where it belongs.”

This tax would also be used to decrease property taxes by using sales tax funds to pay off outstanding building bonds or avoid levying property taxes by using sales tax funds to pay for facility projects that would have been paid for with property taxes.

When school boards representing more than 50% of the resident student enrollment in the country adopt resolutions, the regional superintendent must certify the question to the County clerk.

The county clerk will then place it on the ballot at the next regularly scheduled election, and it needs only a simple majority to pass.